DMT

Guy on Rocks: Gold’s bustling rally comes at the right time for this recovering ASX producer

With their balance sheet restored and some improving operational performance, it appears Resolute’s fortunes may be turning the corner. … Read More

The…

- Gold continues five-week rally to US$1,927/ounce; copper another strong performer in January

- Spodumene prices remain high, rare earths rebound

- Stock of the Week: Resolute Mining (ASX:RSG)

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Smelling the roses

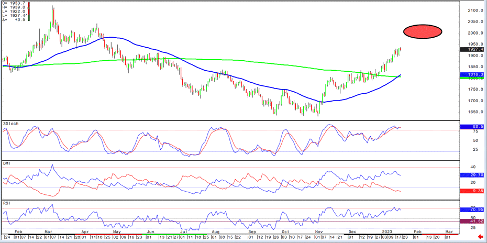

Metal prices have got off to a stellar start in 2023 with gold continuing a five-week rally to close up US$7 to finish at US$1,927/ounce (Figure 1).

The world’s largest gold fund SPDR (NYSE: GLD) however gives no indication of gold’s strength with ETF demand continuing to wane with holdings as at 19 January down 5.21 tonnes.

I am going with Bank of America who are bullish on gold and believe we have another three years of strong gold prices; another US$100/oz will see an all-time record high price for the yellow metal.

In November 2022, European Fund Manager HANetf surveyed 100 European and British fund managers with 89% indicating a preference for increasing their gold exposure. A weakening USD has no doubt had a strong influence in recent months on gold price moves and the market is currently pricing in a 25-basis point increase from the Federal Reserve next month.

With inflation having likely peaked, it appears that bonds (at their highest level since September 2022) and gold are playing their role as data continues to show a deteriorating US economy.

According to Kitco contributor Philip Streible, the economy has crossed into the “dark side” where slowing economic growth without a Fed pivot could take down stocks. Streible believes that moves in bonds and gold support that thesis with silver likely to follow.

Copper (figure 2) has also been another strong performer in January and closed the week at US$4.21/lb, its highest price since June last year and up over 11% this month on the back of rising demand from China and supply disruptions in Peru.

Data from the LME last week also showed a significant uptick in long positions (as opposed to previous short covering rallies) and, not surprisingly, the 3-month copper futures remains in healthy contango.

A short position of around 270Kt (11k lots) remains and was likely set around US$3.90/lb so a short covering rally is not out of the question.

Not surprisingly commodity trader Trafigura is angling to take large amounts of copper from LME bonded warehouses which remain at very low levels of 83,325 tonnes (figure 3). No doubt more trader activity like this could place near-term upward pressure on copper prices.

Spodumene prices remain extremely high with Pilbara Minerals (ASX:PLS) reporting an average realised price of US$5,670/dmt for the December Quarter, a 33% QoQ uplift.

In December 2022, PLS announced its 12th BMX auction at US$7,552/dmt (5.5% Li2O), FOB Port Hedland, equivalent to a benchmark (6.0% Li2O), CIF China price of US$8,299/dmt.

Their cash balance has soared to $2.2 billion, up a staggering $851 million for the quarter. Looking back a few years US$500-750/dmt (5.5% Li2O) was a reasonable assumption!

NdPr (neodymium/praseodymium) prices (figure 4) have rebounded after recent lows around US$83/kg in September 2022. The soft market according to Macquarie Research (13 January 2023) was the result of declining magnet production in China due to strict COVID policies.

At the same time, downstream demand outside of China has remained robust. Another positive sign highlighted by Macquarie was a 31% increase in rare earths concentrate contracts by China Northern Rare Earth in late December 2022.

Stock of the Week: a gold producer back from the brink

Debt laden Resolute (ASX:RSG) (figure 5, 6) has endured a tough 24 months which saw some serious underperformance at the Syama Gold Mine in Ghana, culminating in a heavily dilutive $170 million capital raising at 16 cents in December last year.

With their balance sheet restored and some improving operational performance, it appears RSG’s fortunes may be turning the corner.

The company has recorded four consecutive quarters of gold production growth with a significant lift in underground grades from 2.40g/t to 2.71g/t gold. The Syama Sulphide plant has also seen a 29% increase in throughput following the Q1 2022 shutdown with oxide milling improving from 1.3Mtpa to 1.5Mtpa.

A PFS is also underway which will evaluate low capex expansion options for Syama sulphide and is scheduled for completion in Q1 2023. This will examine:

- Potential open pit resource may provide low capex feed to an expanded sulphide circuit 2, 3, 4

- Evaluating 30-50% expansion of sulphide circuit to 3.1-3.6 Mtpa 3, 4

- Potential to convert oxide circuit to provide additional capacity for the sulphides

Forward looking guidance according to RSG is for FY 2023 to return 345,000 ounces of gold at an all-in-sustaining-cost (AISC) of around US$1,425/ounce which would generate a pre-tax operating cash flow of approximately US$170 million.

Exploration on the broader tenement package seems to be progressing well and the company recently released a 58% increase in JORC Resources at Syama North to 24Mt @ 2.9g/t gold for 3.18 million ounces (1g/t cut-off grade).

There is still significant risk in the operations, however the new look batting line up led by MD and CEO Terry Holohan (who has a background in metallurgy) seems to be delivering results after shareholders received a right royal rogering last year.

Macquarie (11 November 2022) had a valuation of 24 cents back in November last year with gross operating cash flow of around $96 million for FY 2023. I am thinking that might be a little conservative. The operational turnaround, lift in gold prices and sentiment might give RSG a much-needed shot in the arm as we move into 2023.

Next week we will review the performance of this column over the 2022 financial year and the rolling returns to 31 December 2022.

I trust my actuarial friends at RM Corporate Finance will do the right thing but there are no guarantees. As part of our professional development I have supplied the seminal publication by Huff “Manipulating Statistics: the top 10 techniques” so hopefully the right numbers will be forthcoming.

What could possibly go wrong?

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

The post Guy on Rocks: Gold’s bustling rally comes at the right time for this recovering ASX producer appeared first on Stockhead.

dmt stocks etf shares fund capital research

-

Psychedelics1 week ago

Psychedelics1 week agoExploring Psilocybin’s Potential in Diabetes Management

-

Psychedelics1 week ago

Psychedelics1 week agoCybin to Present at the 2024 Bloom Burton & Co. Healthcare Investor Conference

-

Psychedelics1 week ago

Psychedelics1 week agoAll About the New Ketamine Trial at the University of Otago

-

Law & Regulation1 week ago

Canada’s Optimi Health to ship psilocybin to New Zealand psychedelics research center

-

Law & Regulation1 week ago

Law & Regulation1 week agoSynaptogenix increases psilocybin stake with PsygaBio

-

Psychedelics7 days ago

Psychedelics7 days agoThe EU’s Plan for a €6.5M Study of Psychedelics To Treat Mental Disorders

-

Psychedelics1 week ago

Psychedelics1 week agoExploring Psilocybin’s Potential in Diabetes Management

-

Psychedelics7 days ago

Psychedelics7 days agoThe EU’s Plan for a €6.5M Study of Psychedelics To Treat Mental Disorders