Law & Regulation

Relmada Therapeutics trims losses, slashes research costs

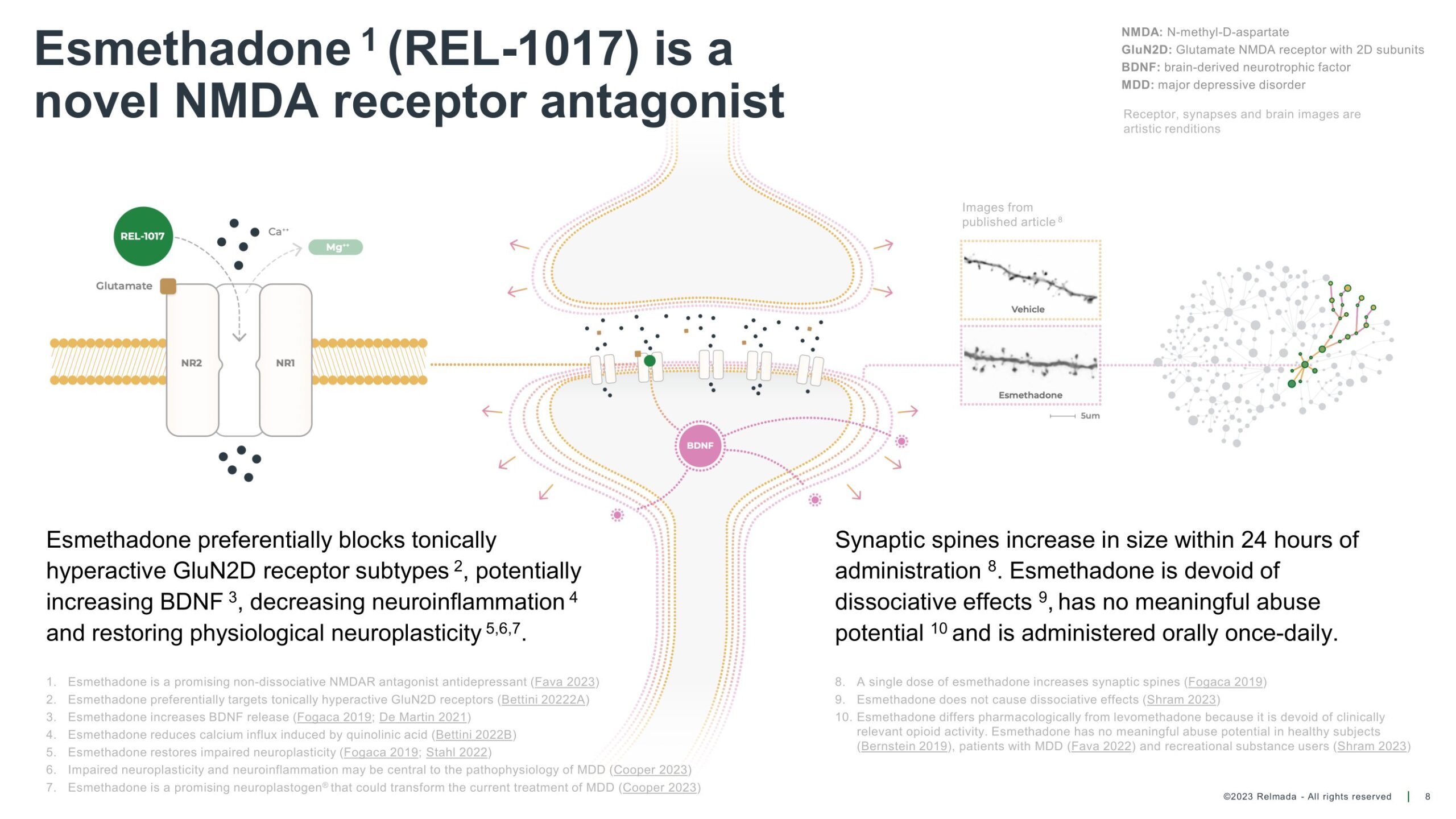

The firm is trying to advance its lead compound, REL-1017, through late-stage clinical trials.

The post Relmada Therapeutics trims losses, slashes research…

Relmada Therapeutics, Inc. (Nasdaq: RLMD) announced its financial results for the fourth quarter and full year ending Dec. 31, 2023, which saw a sizable fall in research spend mostly due to the completion of two Phase 3 trials and a long-term safety study.

The company posted research and development expenses totaling $14.8 million for the quarter, down from $26.9 million in the same period of the previous year.

The firm’s general and administrative expenses slightly increased to $12.1 million in the quarter, up from $11.8 million a year earlier, mainly due to higher employee-related costs.

Relmada’s net loss for the quarter improved to $25.2 million, or $0.84 per share, compared to a net loss of $37.9 million, or $1.28 per share, in the fourth quarter of 2022. For the full year, the company’s net loss decreased to $98.8 million from $157 million in the previous year.

The company’s CEO, Sergio Traversa, mentioned progress in the Phase 3 program for their drug candidate, REL-1017, for treating major depressive disorder.

“Enrollment in the ongoing Reliance II (study 302) is steadily proceeding, and we expect top line data in the second half of 2024,” Traversa said in a statement.

“In our second Phase 3 trial for REL-1017, Relight (study 304), we began dosing patients during the third quarter of last year, and we plan to complete enrollment in this study by year-end 2024.”

For clarity, REL-1017 is not a psychedelic; it’s an N-methyl-D-aspartate (NMDA) receptor antagonist studied for depression treatment. Unlike psychedelics like LSD or psilocybin, which mainly affect serotonin receptors and alter perception, REL-1017 targets NMDA receptors, influencing brain function without inducing psychedelic effects.

The year-end cash, cash equivalents, and short-term investments stood at approximately $96.3 million, down from $148.3 million at the end of 2022.

The firm’s liquidity position contracted a bit, with cash reserves slumping to $96.3 million from $148.3 million in the previous year, partly due to the capital-intensive nature of late-stage pharmaceutical development.

Clinically, the firm said it is progressing decent, with key data from ongoing studies anticipated in the near future.

Additionally, the company is venturing into metabolic disorder treatments with its psilocybin program, targeting obesity, which is set to enter early-stage clinical trials.

“This will be followed by a Phase 2a trial to establish clinical proof-of-concept,” Traversa said.

The post Relmada Therapeutics trims losses, slashes research costs appeared first on Green Market Report.

research psychedelics psychedelic psilocybin lsd

-

Psilocybin1 week ago

Psilocybin1 week agoAre Shrooms Legal in Oregon: Full Guide

-

Psychedelics1 week ago

Psychedelics1 week agoAtai Life Sciences Announces the Publication of Beckley Psytech’s Phase 1 Study of BPL-003 in the Journal of Psychopharmacology

-

Law & Regulation1 week ago

Law & Regulation1 week agoClearmind signs agreement with Hebrew University for psychedelic compound rights

-

Psychedelics1 week ago

Psychedelics1 week agoCybin Announces Publication of Research Manuscript in the Journal of Medicinal Chemistry

-

Psilocybin1 week ago

Psilocybin1 week agoCalifornia advances bill for psychedelics centers

-

Psychedelics1 week ago

Psychedelics1 week agoPsychedelics Can Offer More Than Therapy On Its Own

-

Psychedelics1 week ago

Psychedelics1 week agoRevive Therapeutics Announces FDA Acceptance of Meeting Request for Long COVID Diagnostic Product

-

Psilocybin3 days ago

Psilocybin3 days agoPassover Perspectives: Psychedelics, Moses, and the Burning Bush