Markets & Investing

Bulk Buys: Is iron ore flattering to deceive?

Chinese policy shift inspires a run on iron ore by traders. But experts warn the optimistic mood could be short-lived. … Read More

The post Bulk Buys:…

- Iron ore rockets up 6% in a day as traders latch onto signs of policy support

- Experts say fundamentals remain tough for China’s embattled steel industry, urge caution on iron ore-ptimism

- CZR eyes low cash costs for Robe Mesa operation

Up 6% in a day on Monday there are already signs iron ore’s memecoin-lite surge was a flash in the pan, with Singapore prices yesterday falling 3.56% to US$101.70/t.

Back above the significant US$100/t mark, it is looking a touch more positive this week for iron ore.

But fundamentals still seem to be working against the commodity as China’s steel sector continues to lose money.

The steam for the unusually large single day lift in 62% Fe iron ore prices seemed to come from new rules in China helping big state-owned companies have greater access to bond markets.

A sign of loosening monetary policy, it is the sort of sentiment-heavy public policy that can send speculators and traders running to tip on future demand.

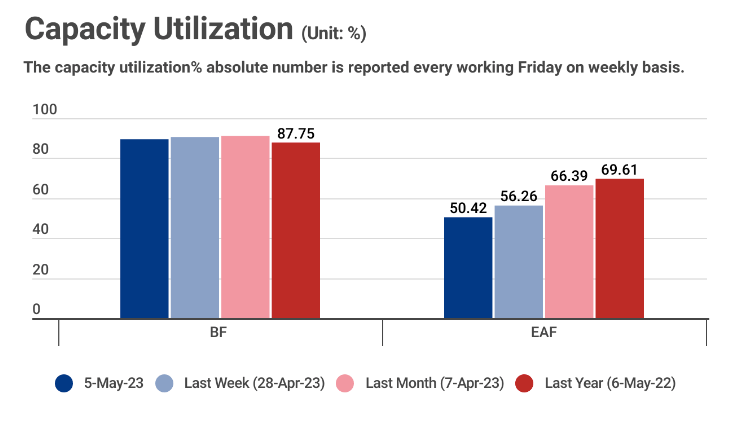

But in the real world, MySteel says blast furnace utilisation fell for third straight week to below 90%, with its research team predicting prices will continue to decline for major steel products.

“There is no substantial replenishment after the Chinese May Day holiday as expected,” they said.

“According to the data from China Index Holdings Ltd, the property sale area in 100 major Chinese cities in April dropped by over 20% from last month, weighing on steel prices.

“In addition, outdoor construction activities and the purchases of end users in May are limited due to increased rainfall and high-temperature weather across the country.”

EAF steel mills, which are heavily exposed to energy prices, have reduced production of long products because they are seeing losses in excess of 100RMB/t.

Blast furnaces have been protected somewhat because of falling coke prices, but daily crude steel output has still fallen to around 2.4Mt a day.

Be cautious until fundamentals improve

The potential for a bottom and turnaround on the recent mini-bear run could inspire a rush back into iron ore stocks.

But Commbank’s Vivek Dhar has warned investors to be cautious on the price spike.

While infrastructure and construction investment has been solid in 2023 so far, it only accounts for around 20-25% of Chinese steel demand.

Around 30-40% comes from property, which remains a sticky wicket.

“While China’s infrastructure sector has helped drive China’s steel demand in the past, any outlook on China’s steel demand will have to incorporate a view on China’s property sector (35‑40% of China’s steel demand),” Dhar said.

“China’s property sector has shown an improvement in certain areas. New home prices in China have increased in February and March. Floor space sold (in square metres) has also stabilised in year‑on‑year terms.

“These outcomes bode well for a recovery in China’s property sector.

“However, with new floor space starts (in square metres) falling 19%/yr in Q1 2023, after plunging ~39%/yr in 2022, there are still good reasons to question the recovery in China’s property sector. New floor space starts correlate more directly with steel demand from China’s property sector.”

Dhar said the sharp rise in prices on Monday showed the market was sensitive to signs of policy support.

Whether it results in a real upswing for commodity demand remains uncertain.

“We expect commodity markets to remain reactive to any signs of policy support. That should keep iron ore prices volatile in the short term,” he said.

“The line in the sand for policy support likely needs outcomes for China’s commodity intensive economy to deteriorate more than it has in the past.

“Our view reflects the conservative growth target of ‘around 5%’ being targeted in 2023. FAI growth would likely need to meaningfully slow further to prompt more policy support.

“Around RMB1.1tn of unused local government special bond issuance from last year is available to support infrastructure spending for the remainder of this year.”

CZR eyes low costs for Robe Mesa

Long floated as a takeover target for Rio Tinto (ASX:RIO), which has been drilling just across its tenement boundary, Robe Mesa iron ore project owner CZR Resources (ASX:CZR) has delivered a 27.3Mt reserve for its Robe Mesa iron ore mine, with costs that would place it far below those of other junior iron ore miners.

With a stripping ratio of 1:1 and only 0.3:1 in its first 18 months, Robe Mesa has a 55.5% Fe grade (calcined 62.2% Fe) and would deliver a DSO hematite product at C1 cash costs of $57/wmt FOB, equivalent to US$39/t FOB.

That’s around double the cash cost of majors Rio, BHP and Fortescue, but well below junior peers such as Fenix Resources (ASX:FEX).

The Creasy backed explorer says the project would be a sinter blend substitute for FMG’s Super Special Fines and Rio’s Robe Valley Fines, generating $260m in free cash over an initial eight-year mine life with an IRR of 70% and NPV of $138m at an iron ore price of US$90/dmt CFR.

At US$106/dmt those metrics would lift to $604m, 149% and $342m respectively.

“The increased Reserves allow CZR to design a larger, lower-cost and more sustainable iron ore project than identified under the 2020 PFS,” CZR MD Stefan Murphy said.

A DFS is pending.

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.01 | 0% | -60% | -60% | -83% | $ 4,731,272.83 |

| ADY | Admiralty Resources. | 0.007 | 17% | 0% | 0% | -53% | $ 9,125,054.07 |

| AKO | Akora Resources | 0.14 | -10% | -22% | -22% | -44% | $ 10,467,580.45 |

| BCK | Brockman Mining Ltd | 0.027 | -10% | -7% | 8% | -37% | $ 278,406,963.93 |

| BHP | BHP Group Limited | 44.47 | 2% | -1% | 8% | 8% | $ 226,543,495,264.32 |

| CIA | Champion Iron Ltd | 6.65 | 4% | -2% | 28% | -6% | $ 3,387,614,975.30 |

| CZR | CZR Resources Ltd | 0.19 | 19% | 12% | -11% | 4% | $ 44,789,582.74 |

| DRE | Dreadnought Resources Ltd | 0.054 | -8% | -21% | -46% | 38% | $ 192,138,236.76 |

| EFE | Eastern Resources | 0.011 | 0% | -4% | -71% | -72% | $ 13,661,411.07 |

| CUF | Cufe Ltd | 0.013 | 0% | -13% | -13% | -55% | $ 11,593,348.38 |

| FEX | Fenix Resources Ltd | 0.245 | 7% | 2% | 14% | -13% | $ 134,357,241.60 |

| FMG | Fortescue Metals Grp | 20.58 | -1% | -5% | 20% | 5% | $ 63,549,835,907.52 |

| FMS | Flinders Mines Ltd | 0.48 | -2% | 20% | -4% | -4% | $ 81,047,316.96 |

| GEN | Genmin | 0.16 | -9% | -16% | -36% | -20% | $ 72,205,317.44 |

| GRR | Grange Resources. | 0.595 | -1% | -12% | -18% | -53% | $ 705,976,605.78 |

| GWR | GWR Group Ltd | 0.077 | -3% | 1% | 33% | -43% | $ 24,733,682.44 |

| HAV | Havilah Resources | 0.28 | 14% | -10% | -10% | 65% | $ 83,909,390.65 |

| HAW | Hawthorn Resources | 0.07 | -13% | 0% | -18% | -44% | $ 23,451,092.91 |

| HIO | Hawsons Iron Ltd | 0.049 | -4% | -21% | -55% | -90% | $ 45,953,552.95 |

| IRD | Iron Road Ltd | 0.099 | -1% | -8% | -21% | -45% | $ 76,654,689.84 |

| JNO | Juno | 0.075 | -12% | -18% | -18% | -29% | $ 10,174,350.08 |

| LCY | Legacy Iron Ore | 0.015 | -6% | -12% | -17% | -38% | $ 96,102,392.99 |

| MAG | Magmatic Resrce Ltd | 0.125 | 4% | 14% | 9% | 79% | $ 39,740,063.74 |

| MDX | Mindax Limited | 0.14 | 0% | -10% | 137% | 137% | $ 296,606,023.10 |

| MGT | Magnetite Mines | 0.55 | 1% | -6% | -35% | -58% | $ 40,952,632.86 |

| MGU | Magnum Mining & Exp | 0.017 | 0% | -19% | -41% | -75% | $ 11,982,933.97 |

| MGX | Mount Gibson Iron | 0.44 | -8% | -12% | 0% | -32% | $ 534,344,506.52 |

| MIN | Mineral Resources. | 73.5 | 1% | -3% | -11% | 37% | $ 13,841,501,345.15 |

| MIO | Macarthur Minerals | 0.165 | 0% | 18% | 14% | -51% | $ 24,848,023.20 |

| PFE | Panteraminerals | 0.085 | 4% | -7% | -45% | -39% | $ 4,377,595.20 |

| PLG | Pearlgullironlimited | 0.033 | 10% | -11% | 40% | -39% | $ 5,161,735.85 |

| RHI | Red Hill Minerals | 4.7 | 2% | 6% | 24% | 16% | $ 287,226,670.50 |

| RIO | Rio Tinto Limited | 111.44 | 0% | -4% | 13% | 4% | $ 41,561,367,319.44 |

| RLC | Reedy Lagoon Corp. | 0.007 | 0% | -13% | -30% | -73% | $ 3,967,037.21 |

| CTN | Catalina Resources | 0.005 | 0% | 0% | -29% | -55% | $ 6,192,434.46 |

| SRK | Strike Resources | 0.053 | -9% | -15% | -47% | -70% | $ 16,457,500.00 |

| SRN | Surefire Rescs NL | 0.017 | -6% | -23% | 55% | -41% | $ 26,883,179.11 |

| TI1 | Tombador Iron | 0.021 | -5% | -16% | 5% | -40% | $ 44,876,629.83 |

| TLM | Talisman Mining | 0.17 | 6% | 21% | 26% | 6% | $ 30,977,017.01 |

| VMS | Venture Minerals | 0.018 | 6% | 6% | -18% | -59% | $ 31,850,236.66 |

| EQN | Equinoxresources | 0.12 | -8% | -23% | 0% | -17% | $ 5,850,000.13 |

| AMD | Arrow Minerals | 0.004 | -20% | -11% | -20% | 33% | $ 12,095,060.38 |

Thermal coal back at pre-Ukraine levels

Thermal coal meanwhile has returned to levels last seen before the invasion of the Ukraine by Russia.

Having lifted to US$450/t and above last year, Newcastle 6000kcal thermal coal prices are back below US$170/t.

Coking coal, which surged this year, is still at very high levels but at US$244/t has contracted from the heady levels of over US$350/t the steelmaking ingredient hit after China reopened trade from Australia.

That has come alongside the pullback in iron ore prices, as clouds have gathered over Chinese steel demand.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.005 | 0% | -17% | -38% | -64% | $ 7,179,494.55 |

| CKA | Cokal Ltd | 0.155 | -3% | -6% | -31% | -6% | $ 172,631,836.80 |

| NCZ | New Century Resource | 1.1 | 0% | -7% | 2% | -49% | $ 148,482,094.20 |

| BCB | Bowen Coal Limited | 0.24 | -6% | -8% | -26% | -20% | $ 451,217,315.85 |

| SVG | Savannah Goldfields | 0.165 | 0% | -8% | -18% | -18% | $ 31,159,992.27 |

| GRX | Greenx Metals Ltd | 0.76 | -1% | 33% | 158% | 280% | $ 203,432,573.64 |

| AKM | Aspire Mining Ltd | 0.064 | 7% | 16% | -32% | -23% | $ 29,950,582.12 |

| AVM | Advance Metals Ltd | 0.008 | -11% | 0% | -43% | -53% | $ 5,820,440.69 |

| AHQ | Allegiance Coal Ltd | 0.013 | 0% | 0% | -75% | -97% | $ 13,063,647.08 |

| YAL | Yancoal Aust Ltd | 5.54 | -5% | -1% | -7% | 11% | $ 7,473,687,213.42 |

| NHC | New Hope Corporation | 5.25 | -9% | -1% | -29% | 57% | $ 4,702,496,312.41 |

| TIG | Tigers Realm Coal | 0.01 | -20% | -23% | -29% | -33% | $ 130,667,023.68 |

| SMR | Stanmore Resources | 3.24 | -2% | 1% | 17% | 54% | $ 2,947,550,643.18 |

| WHC | Whitehaven Coal | 7.22 | 5% | 9% | -31% | 50% | $ 6,562,680,948.18 |

| BRL | Bathurst Res Ltd. | 1.0025 | -4% | 8% | 9% | -14% | $ 197,100,573.40 |

| CRN | Coronado Global Res | 1.66 | 2% | 0% | -10% | -11% | $ 2,799,677,729.10 |

| JAL | Jameson Resources | 0.07 | -11% | -3% | 8% | -17% | $ 30,929,376.90 |

| TER | Terracom Ltd | 0.615 | -7% | 12% | -39% | 6% | $ 484,584,572.18 |

| ATU | Atrum Coal Ltd | 0.005 | 0% | 0% | -38% | -54% | $ 6,958,495.86 |

| MCM | Mc Mining Ltd | 0.2 | 25% | 29% | -9% | 64% | $ 83,929,692.42 |

| DBI | Dalrymple Bay | 2.67 | -2% | 2% | 11% | 22% | $ 1,333,598,884.23 |

The post Bulk Buys: Is iron ore flattering to deceive? appeared first on Stockhead.

dmt investors stocks research public policy

-

Psilocybin6 days ago

Psilocybin6 days agoPassover Perspectives: Psychedelics, Moses, and the Burning Bush

-

Psychedelics1 week ago

Psychedelics1 week agoPsychedelics Can Offer More Than Therapy On Its Own

-

Psychedelics5 days ago

Psychedelics5 days agoAlgernon NeuroScience and the Centre for Human Drug Research to Present DMT Phase 1 Stroke Clinical Data at the Interdisciplinary Conference on Psychedelic Research June 6 – 8th, 2024

-

Psychedelics6 days ago

Psychedelics6 days agoRevive Therapeutics Announces Type C Meeting Request Granted by FDA for Clinical Study of Bucillamine to Treat Long COVID

-

Psychedelics5 days ago

Psychedelics5 days agoatai Life Sciences Announces Dosing of First Patient in Part 2 of Beckley Psytech’s Phase 2a Study Exploring BPL-003 Adjunctive to SSRIs in Patients with Treatment Resistant Depression

-

Law & Regulation5 days ago

Law & Regulation5 days agoTryp Therapeutics merger with Exopharm approved by shareholders

-

Psychedelics6 days ago

Psychedelics6 days agoSilo Pharma Announces Positive Results for Intranasal PTSD Treatment

-

Psychedelics6 days ago

Psychedelics6 days agoOptimi Health and Kwantlen Polytechnic University Applied Genomics Centre Partner to Advance Mushroom Science and Research