DMT

Ground Breakers: Good news, bad news in Allkem’s lithium results and coal miners keep doing their thing

Allkem shares fall as investors digest poor quarter at Mt Cattlin Wet weather hammers Yancoal production but record thermal prices … Read More

The post…

- Allkem shares fall as investors digest poor quarter at Mt Cattlin

- Wet weather hammers Yancoal production but record thermal prices drive coal miner to strong ever position

- Stanmore remains on track at Queensland met coal mines, says demand for coking coal is coming back

Allkem (ASX:AKE) has laid bare the challenges it faced in the September quarter at the Mt Cattlin lithium mine near Ravensthorpe in WA, where labour shortages forced a cut in FY23 guidance a couple months ago.

The second largest standalone lithium miner trimmed production forecasts for Cattlin from 160-170,000t to 140-150,000t due to processing and labour concerns back in August after producing more than 200,000t in FY22.

But the September quarter has been even weaker than expected, with recoveries of just 25% due to the fine grained nature of the ore currently being mined.

Lower grades in he 0.93-0.94% range while the 2NW pit is developed are also well below 1.17% expected in FY24, with an additional 60,000t to be sold from low grade stockpiles and fine grained ore to make up the gap.

Just 17,606dmt of spodumene was produced at a 5.3% Li2O grade, with 21,215t at 5.4% Li2O shipped.

Now for the good news, prices are still rowdy as.

For that sub grade material Allkem picked up an average realised sales price of US$5028/dmt, pulling in US$107m in revenue, with an additional US$35m pulled in from shipments of 59,326dmt of low grade spod, against a cash cost of just US$796/dmt. Even the low grade stuff generated a US$25.6m margin, with an 80%, US$85.4m margin for the primary material.

Allkem generates its pit shells at just US$1100/t for 6% Li2O spodumene concentrate.

Concentrate pricing is expected to be in line with the September quarter in December, potentially a point of concern for investors used to spodumene only going up.

Lithium carbonate prices are still rising, with third party sales from the Olaroz brine in Argentina of US$43,237/t FOB in the September quarter, expected to lift 15% to US$50,000/t in the December quarter.

Allkem produced 3289t of lithium carbonate (up 17%), 43% of it battery grade, with sales of 3721t generating a gross cash margin of 89% and record quarterly revenue of US$150m.

Allkem (ASX:AKE) share price today:

Australia’s largest pure play coal miner “never been stronger”

Yancoal (ASX:YAL), owner of one of Australia’s largest fleets of thermal coal mines and the largest pure play coal miner on the ASX, says it has never been in such a strong position, boasting a cash balance of $3.4 billion as of September 30.

YAL is the latest to show the impact of wet weather and labour shortages on its operations over the past three months, with its thermal coal production of 5.8Mt in the third quarter 35% down on the same period in 2021 and 12% lower than the June quarter this year.

Met coal output was off 40% YoY and 31% QoQ to 0.9Mt, with year to date output off 18% and 21% respective for energy and met coal at 19.1Mt and 3.3Mt.

It highlights the recent and persistent tightness in coal markets, with wet weather in Australia that has curbed production from the likes of Whitehaven and BHP combining with the sanctioning of Russian material to keep prices at record highs.

At an average realised selling price of $481/t, Yancoal added some $1.9b in cold hard cash to its bank account on 7.3Mt of attributable saleable coal production (13.2Mt on a 100% basis).

“The Company has transformed its financial position, has the capacity to pursue new endeavours, and will ultimately deliver a production recovery once the heavy rains cease,” CEO David Moult said.

“Continuing supply side constraints, combined with global energy

uncertainty, has sustained elevated international thermal coal prices. While there may be volatility, we anticipate prices to remain well supported into 2023.”

Yancoal expects to produce 31-33Mt at $84-89/t in 2022.

The company says supply-side constraints are only part of the story for coal, with its favourable economics compared to gas driving demand beyond 2013’s record to 8Bt.

“In Europe, favourable economics for coal plants amid extremely high gas and power prices has resulted in increased coal-fired power generation, and fuel security mandates continue to drive coal imports,” the company said.

“Conversely, Chinese industrial activity has slowed, with several major cities addressing COVID-19 cases, impacting power generation demand and obscuring the mid-to-long-term demand profile.

“All these factors affect sentiment and contribute to thermal coal price volatility in the thinly traded thermal coal spot markets. Thermal coal prices, and particularly high-energy thermal coal prices, seem likely to be well supported for the remainder of 2022 and into 2023.”

Yancoal (ASX:YAL) share price today:

Stanmore sees met market tightness returning

Emerging coal miner Stanmore (ASX:SMR) meanwhile said it remained on track to hit second half 2022 targets despite wet weather and cost pressures at its Queensland mines.

It delivered 5.1Mt run of mine and saleable production of 3.2Mt in the September quarter, including monthly ROM records of 814,000t at Poitrel and 406,000t at Isaac Plains in August.

The company has significantly upsized after buying out BHP’s stake in the BMC mines in May, adding the 20% of the now SMC operation owned by minority partner Mistui in early October.

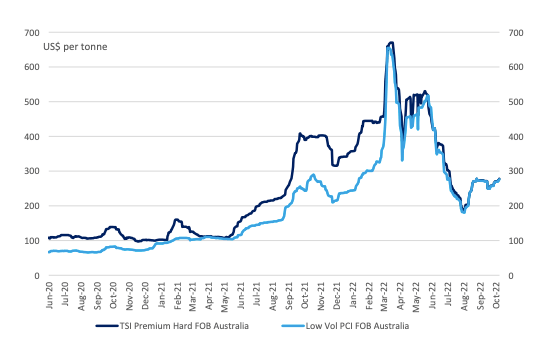

While met coal prices softened at the start of the quarter, falling to a more than US$150/t deficit to typically cheaper high energy thermal coal, a number of factors are bringing demand for coking coal back despite weakness in global steel demand.

“The metallurgical coal market softened early in the quarter but showed recovery by quarter end, with demand currently stable from all markets and elevated supply risk from forecasted wet weather

in 4Q, continued swing of metallurgical coal volumes into thermal coal markets given the price arbitrage, and ongoing tightness in the Australian labour market,” Stanmore CEO Marcelo Matos said.

With the Russian coal ban crimping PCI supplies, the typically discounted product has been catching up to hard coking coal pricing, with Stanmore saying it has increased the percentage of its coal sold as PCI quarter on quarter.

Stanmore (ASX:SMR) share price today:

The post Ground Breakers: Good news, bad news in Allkem’s lithium results and coal miners keep doing their thing appeared first on Stockhead.

dmt investors shares

-

Psychedelics7 days ago

Psychedelics7 days agoExploring Psilocybin’s Potential in Diabetes Management

-

Psychedelics1 week ago

Psychedelics1 week agoCybin to Present at the 2024 Bloom Burton & Co. Healthcare Investor Conference

-

Psychedelics7 days ago

Psychedelics7 days agoAll About the New Ketamine Trial at the University of Otago

-

Law & Regulation1 week ago

Canada’s Optimi Health to ship psilocybin to New Zealand psychedelics research center

-

Law & Regulation1 week ago

Law & Regulation1 week agoSynaptogenix increases psilocybin stake with PsygaBio

-

Psychedelics6 days ago

Psychedelics6 days agoThe EU’s Plan for a €6.5M Study of Psychedelics To Treat Mental Disorders

-

Psychedelics6 days ago

Psychedelics6 days agoThe EU’s Plan for a €6.5M Study of Psychedelics To Treat Mental Disorders

-

Psychedelics7 days ago

Psychedelics7 days agoExploring Psilocybin’s Potential in Diabetes Management