DMT

Tesla is selling more cars than ever. These are the ASX stocks in bed with it

Here’s a who’s who of ASX stocks in supply deals with Tesla, the world’s largest EV manufacturer, for a range … Read More

The post Tesla is selling more…

Tesla, the world’s largest EV manufacturer, has once again shattered expectations with its delivery of a record 466,140 cars worldwide between the months of April and June, exceeding estimates by Wall Street analysts.

That’s a lot of cars, and as we all know, electric vehicles need a bucketload of minerals – not just lithium – to help power them.

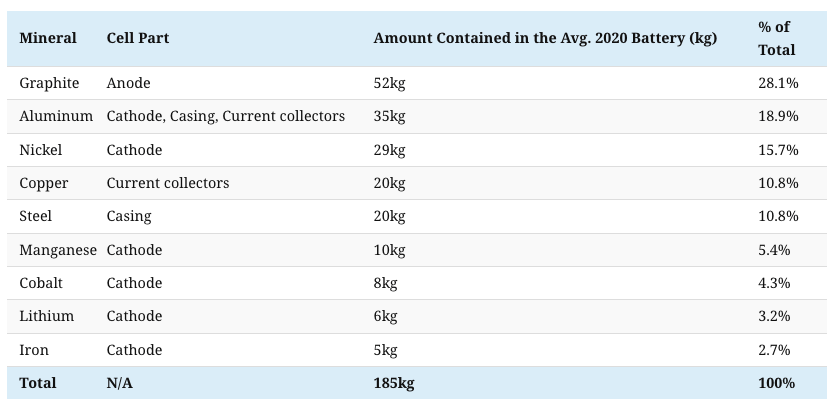

The battery minerals mix of a 60-kilowatt hour (kWh) battery contains roughly 185 kilograms of minerals, excluding materials used in the electrolyte, binder, separator, and battery pack casing.

According to experts, the cathode is not only the most expensive component of the battery, but it also holds the widest variety of minerals – the different combination of minerals give rise to the many different battery characteristics.

Around 52kg of graphite is used for the anode (28.1% of the battery) meaning by weight, it is the largest component in lithium-ion batteries.

In fact, lithium-ion batteries contain about 10-15 times more graphite than lithium, which explains why Tesla has locked in a deal with ASX listed graphite developer Magnis Energy (ASX:MNS) for the supply of a minimum 17,500tpa of active anode material (AAM) beginning in February 2025 for a minimum term of three years with fixed pricing.

Magnis’ deal with Tesla

Magnis has also fulfilled one of the key conditions of the deal by securing the location of the commercial AAM facility in the southwest of the US – chosen from amongst the sites undergoing an advanced review along with shortlisted sites in the Midwest and Southeast regions.

Proximity to logistics and key off-takers have been key considerations for the shortlisted sites that have completed evaluations for size, power, and infrastructure requirements, along with expansion possibilities, the company said.

In an interview with Stockhead Magnis group communications manager Con Hoursalas said work will begin immediately on completing a demonstration plant and in parallel, the process of hiring key personnel and staff for the project.

“Magnis understands the scale of the green energy transition and that it is going to be a challenging effort requiring the collaboration of all stakeholders,” he said.

“Nobody could achieve all this alone.

“We’re proud of what we’ve achieved to date but we also acknowledge that it’s a global objective and therefore success hinges on the involvement of both government entities and established commercial players,” Hoursalas added.

“And we’re already seeing this with the IRA (Inflation Reduction Act) in the US and the nascent National Battery Strategy here in Australia.”

NOW READ: Magnis ups stake in iM3NY Battery Plant

Which other ASX stocks have deals with Tesla?

SYRAH RESOURCES (ASX:SYR)

Syrah executed its offtake agreement with Tesla to supply natural graphite AAM from the 11.25ktpa AAM facility in Vidalia, Louisiana back in December 2021 and has also finalised AAM specifications in this offtake agreement.

Further to the 8,000tpa AAM offtake obligation, Tesla exercised an option in December 2022 to offtake an additional 17ktpa AAM from Vidalia at a fixed price and for an initial term of no less than four years, subject to the further expansion of Vidalia’s production capacity to 45,000tpa.

Tesla’s offtake obligation is a key customer commitment for a final investment decision (FID) on the Vidalia Further Expansion project, accounting for a combined 56% of the planned production capacity.

LIONTOWN RESOURCES (ASX:LTR)

From 2024, Liontown will supply Tesla 100,000 dry metric tonnes (DMT) of spodumene concentrate from the Kathleen Valley project in WA in the first year, increasing to 150,000 DMT per year for the remaining five-year term.

The offtake deal represents about one-third of the project’s start up spodumene concentrate production capacity of ~500ktpa.

Liontown also has a deal with Ford which includes the supply of up to 150,000 DMT of spodumene per year for a period of five years once its Kathleen Valley lithium mine kicks off production in 2024.

A $300mn debt facility was also agreed upon for the mine from a Ford unit to further develop the project.

During the March quarter, Liontown’s chair, and managing director and CEO undertook a market engagement visit to the United States of America in February.

The visit included senior level discussions with major customers, Ford and Tesla, and tours of their respective manufacturing facilities, engagements with senior bureaucrats and policy makers in Washington DC.

BHP Group (ASX:BHP)

BHP’s deal with Tesla started in 2022 for the supply of up to 18,000 tonnes of class 1 nickel per year from the Nickel West asset and processed at the company’s new nickel sulphate plant in Kwinana, WA which is expected to produce 100,000 tonnes per year when fully operational.

The two companies will also collaborate on ways to make the battery supply chain more sustainable.

With Ford, BHP has entered into an MoU for nickel supply, which could start as early as 2025 and may involve additional commodities over time.

The company has also inked a deal to supply nickel sulphate to a battery-making joint venture between Toyota Motors and Panasonic – dubbed Prime Planet Energy & Solutions (PPES).

RIO TINTO (ASX:RIO)

Rio Tinto and joint venture partner Talon Metals Corp will supply Tesla with 75,000 tonnes of nickel concentrate over a six-year period from the Tamarack project in Minnesota.

Under the agreement, Tesla holds the right to negotiate the purchase of nickel concentrate in excess of the initial commitment of 75,000 tonnes.

In its deal with Ford, RIO will supply the automaker with low carbon materials like aluminium, lithium, and copper from its Rincon lithium project in Argentina.

Other ASX stocks co-partnered with big automakers

European Lithium (ASX:EUR) signed a binding long term offtake agreement with BMW for battery grade lithium hydroxide (LiOH) from its Wolfsberg Lithium project in Austria.

Queensland Pacific Metals (ASX:QPM) entered into a binding equity subscription agreement and offtake agreement with General Motors in October 2022 to form the beginning of a “long-term strategic collaboration, and Ioneer’s (ASX:INR) deal with Ford includes the supply of 7,000tpa of lithium carbonate over a five-year term from its Rhyolite Ridge lithium-boron project in Nevada, starting in 2025.

At Stockhead we tell it like it is. While Magnis Energy Technologies, European Lithium, Queesland Pacific Metals, and Ioneer are Stockhead clients they did not sponsor this article.

The post Tesla is selling more cars than ever. These are the ASX stocks in bed with it appeared first on Stockhead.

dmt stocks deal

-

Psilocybin1 week ago

Psilocybin1 week agoCalifornia advances bill for psychedelics centers

-

Psilocybin6 days ago

Psilocybin6 days agoPassover Perspectives: Psychedelics, Moses, and the Burning Bush

-

Psychedelics1 week ago

Psychedelics1 week agoPsychedelics Can Offer More Than Therapy On Its Own

-

Psychedelics5 days ago

Psychedelics5 days agoAlgernon NeuroScience and the Centre for Human Drug Research to Present DMT Phase 1 Stroke Clinical Data at the Interdisciplinary Conference on Psychedelic Research June 6 – 8th, 2024

-

Psychedelics6 days ago

Psychedelics6 days agoRevive Therapeutics Announces Type C Meeting Request Granted by FDA for Clinical Study of Bucillamine to Treat Long COVID

-

Law & Regulation5 days ago

Law & Regulation5 days agoTryp Therapeutics merger with Exopharm approved by shareholders

-

Psychedelics5 days ago

Psychedelics5 days agoatai Life Sciences Announces Dosing of First Patient in Part 2 of Beckley Psytech’s Phase 2a Study Exploring BPL-003 Adjunctive to SSRIs in Patients with Treatment Resistant Depression

-

Psychedelics6 days ago

Psychedelics6 days agoSilo Pharma Announces Positive Results for Intranasal PTSD Treatment