LSD

TECH HEAVY: The Magnificent Seven has suddenly become the Fantastic Four

Wall Street’s latest fresh record highs last week were driven by four, not seven magnificent tech stock performances. So who’s … Read More

The post TECH…

Wall Street’s at record highs.

Last week was just another five sessions trading on the knife’s edge.

The S&P500 ended on Friday looking spritely at its fourth straight record high thanks muchly to more tech earnings you could fall in love with and a blockbuster jobs report to close out the week.

By the numbers, the S&P500 and Dow Jones each put on a circa 1.4% gain, while the tech heavy Nasdaq Composite collected 1.1%.

Wall Street’s latest record high followed Friday’s blowout payroll report which ticked the Confidence in the Economy box, despite adding weight to the Fed’s Wait and See caution.

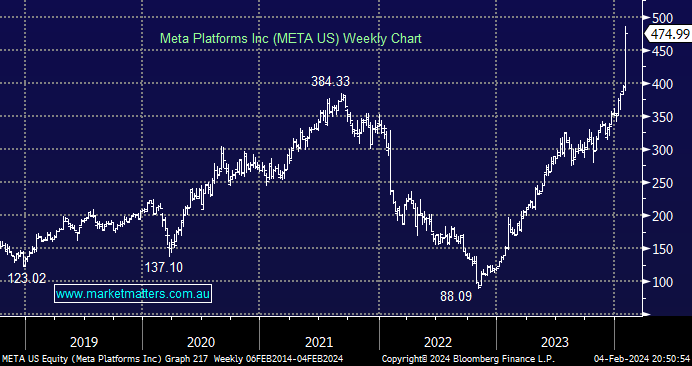

The blockbuster Friday jobs data also drummed up trader confidence in the outlook for corporate activity. Which naturally sparked yet another wildfire rally across tech stocks, with the accelerant provided this time by Meta’s surprise first-ever quarterly dividend, which saw the stock jump by almost a full quarter of market value before the end of the session.

In the same time, Amazon added 8.3% after its own quarterly bonanza.

No surprise then that the US Tech100 closed the week at an all-time high of 17680.

It’s up 8% in four weeks, 41% in 12 months.

The theme over yonder now appears to be equal parts interest rate cycle and underlying strength of the US economy.

Bond yields had driven equities post-COVID, but US earnings season became the new driving factor last week, no real surprise by the baton change on the stock level, but the moves have been extraordinary, propelling US indices higher.

Meta’s 21% surge on Friday made Chief Zuckerburg around $US28bn in one day, a rare move for a stock of this magnitude but we did see Nvidia pop over +24% last May.

“The Magnificent Seven are still a rule unto themselves,” says Market Matters’ boss James Gerrish,

“It is not often the crowd gets so well rewarded, but as last month’s Bank Of America Fund Managers Survey told us, the large-cap US tech stocks were the most crowded place to be invested; so far, so good!”

The Fantastic Four

They ran this town in 2023, yet cracks are starting to appear in the unity of Wall Street’s Magnificent 7.

“Of the (mega tech stocks), last week we saw Meta Platforms, Nvidia, Amazon.com, Alphabet, and Microsoft all make fresh all-time highs while Apple Inc and Tesla struggled, plus Alphabet (GOOGL US) had reversed lower come Friday.”

In other words, James says, it’s become the “Dominant Four”.

Leader of the posse last year was new kid Nvidia – the AI chip maker came away with a 240% gain. Followed at some distance (and in descending order) by Messrs Meta, Tesla and Amazon – each walking away with 195%, 101% and 80%.

Last week, Meta surged after their results beat analyst expectations, and they delivered the company’s first-ever quarterly dividend, plus a $US50bn share buyback program – “greater than the entire market cap of Macquarie Group (ASX:MQG)“, Gerrish points out, with some delight.

MM is now cautiously bullish toward META

So it was really these four tech stocks which propelled the S&P500 to fresh all-time highs last week.

However, Gerrish says that the firming greenback and a pretty convincing show from Beijing that it might not be able to meaningfully turn China’s economy around has led to “the elastic band between the Tech and Materials sector stretching even further.”

“It will snap one day, but the million dollar question remains when? We have been looking for outperformance from the US Tech Sector to reverse in 1Q of 2024, but there are no signs yet…”

MM is looking for the performance baton to reverse in 2024

The Week Ahead

The coming week brims with pivotal events likely to steer the financial markets, starting with Federal Reserve Chair Jerome Powell‘s address on Monday. This speech holds significant weight for investors parsing the tea leaves for hints on US monetary policy.

And US Q4 corporate earnings season are now in full swing.

According to Jean Boivin, head of the BlackRock Investment Institute, whichever way the numbers drop from now, the market is hungry for any glass-half-full opportunity.

“We don’t see (corporate earnings this week) spoiling upbeat risk appetite for now,” Boivin says.

“The S&P 500 hit an all-time high last week as most top tech firms beat high earnings expectations. Yet we think earnings will recover less than markets expect this year after stagnating in 2023. Tech gains and cost cutting have buoyed margins, but we see pressures mounting over time.

“We’re overall overweight US stocks as we think rosy market sentiment can persist for now.”

More of BlackRock’s barely hidden excitement, here.

Elon Watch

The Wall Street Journal is reporting – to the delight of Elon Musk acolytes everywhere – that the Tesla/X/ Space X et al boss has quite the penchant for drug use and that his various board members are feeling a little put upon that they might have to get stuck in when he does.

Unnamed sources told the Journal that Elon’s had a go at (checks notes)… LSD, cocaine, ecstasy and magic mushrooms, usually at private soirees and one of the (less exciting effects) is that some directors at Musk’s various, trippy companies felt a weight of “expectation” to use the drugs with him.

Citing mysterious people familiar with the flamboyant billionaire and his flamboyant companies, the WSJ suggests that it was the various financial ties to Musk’s companies which kept those directors from saying no. Rather than, I don’t know, the law, or health reasons… or even how weird it would be to see the entire board of Tesla tripping off their noggins and wandering unhinged around the Musk family home.

Said people told the newspaper that Elon’s drug use is no momentary experiment but an ongoing ritual. The good news is that his apparent preference for the horse tranquiliser ketamine is legit, because – as the man himself said back in August – he’s got a prescription for it, as an antidepressant.

It seems the tipping point – for SpaceX executives at least – was when a particularly high Elon floated in to a “cringeworthy” company-wide meeting about an hour late, where he lasted 15 minutes “rambling and slurring his words” before the meeting was taken over by someone currently on the right planet.

Good goss.

Meanwhile, Elon’s finding some solid support to get his Tesla remuneration back. Here’s Cathie Wood, the founder of Ark Invest:

Thank you https://t.co/yvyhCrJ7Q2

— Elon Musk (@elonmusk) February 5, 2024

Nice. Touching moment.

US Earnings Highlights

Tuesday February 6 – Friday February 9

Tuesday

Prudential Financial, Chipotle, Ford, Eli Lilly, GE Healthcare Tech

Wednesday

The Walt Disney Co, Wynn Resorts, PayPal, Yum! Brands, Hilton, Uber Technologies, Costco

Thursday

Motorola Solutions, Expedia Group, Ralph Lauren, T. Rowe Price Group, ConocoPhillips, The Hershey Co, Philip Morris, Tapestry

Friday

PepsiCo

The Economic Calendar

Tuesday February 6 – Friday February 10

TUESDAY

Japan Household Spending (Dec)

Philippines Inflation (Jan)

Germany Factory Orders (Dec)

Taiwan Inflation Rate (Jan)

Eurozone Retail Sales (Dec)

Global Sector PMI* (Jan)

WEDNESDAY

Japan Leading Index (Dec)

Germany Industrial Production (Dec)

Thailand BoT Interest Rate Decision

UK Halifax House Price Index (Jan)

France Trade (Dec)

Taiwan Trade (Jan)

Brazil Retail Sales (Dec)

Mexico Consumer Confidence (Jan)

Canada Trade (Dec)

United States Trade (Dec)

Global Metal Users and Electronics PMI (Jan)

THURSDAY

Taiwan, Indonesia Market Holiday

Japan Current Account (Dec)

China (Mainland) CPI, PPI (Jan)

India RBI Interest Rate Decision

Brazil Inflation (Jan)

Mexico Inflation (Jan)

United States Initial Jobless Claims

United States Wholesale Inventories (Dec)

United Kingdom KPMG / REC Report on Jobs (Jan)

FRIDAY

China (Mainland), South Korea, Taiwan, Hong Kong SAR (partial), Singapore (partial): Market Holiday

Germany Inflation (Jan,)

Canada Unemployment (Jan)

The post TECH HEAVY: The Magnificent Seven has suddenly become the Fantastic Four appeared first on Stockhead.

lsd ketamine antidepressant investors stocks trading fund nasdaq invest

-

Law & Regulation1 week ago

Law & Regulation1 week agoClearmind signs agreement with Hebrew University for psychedelic compound rights

-

Psychedelics1 week ago

Psychedelics1 week agoCybin Announces Publication of Research Manuscript in the Journal of Medicinal Chemistry

-

Psilocybin1 week ago

Psilocybin1 week agoCalifornia advances bill for psychedelics centers

-

Psilocybin4 days ago

Psilocybin4 days agoPassover Perspectives: Psychedelics, Moses, and the Burning Bush

-

Psychedelics1 week ago

Psychedelics1 week agoPsychedelics Can Offer More Than Therapy On Its Own

-

Psychedelics1 week ago

Psychedelics1 week agoRevive Therapeutics Announces FDA Acceptance of Meeting Request for Long COVID Diagnostic Product

-

Psychedelics3 days ago

Psychedelics3 days agoAlgernon NeuroScience and the Centre for Human Drug Research to Present DMT Phase 1 Stroke Clinical Data at the Interdisciplinary Conference on Psychedelic Research June 6 – 8th, 2024

-

Psychedelics4 days ago

Psychedelics4 days agoRevive Therapeutics Announces Type C Meeting Request Granted by FDA for Clinical Study of Bucillamine to Treat Long COVID